Pursue Asset Potential, Stability and Growth Potential

- Pursue Asset Potential, Stability and Growth Potential

- Sponsor support by Mori Trust Group

- Solid financial strategy

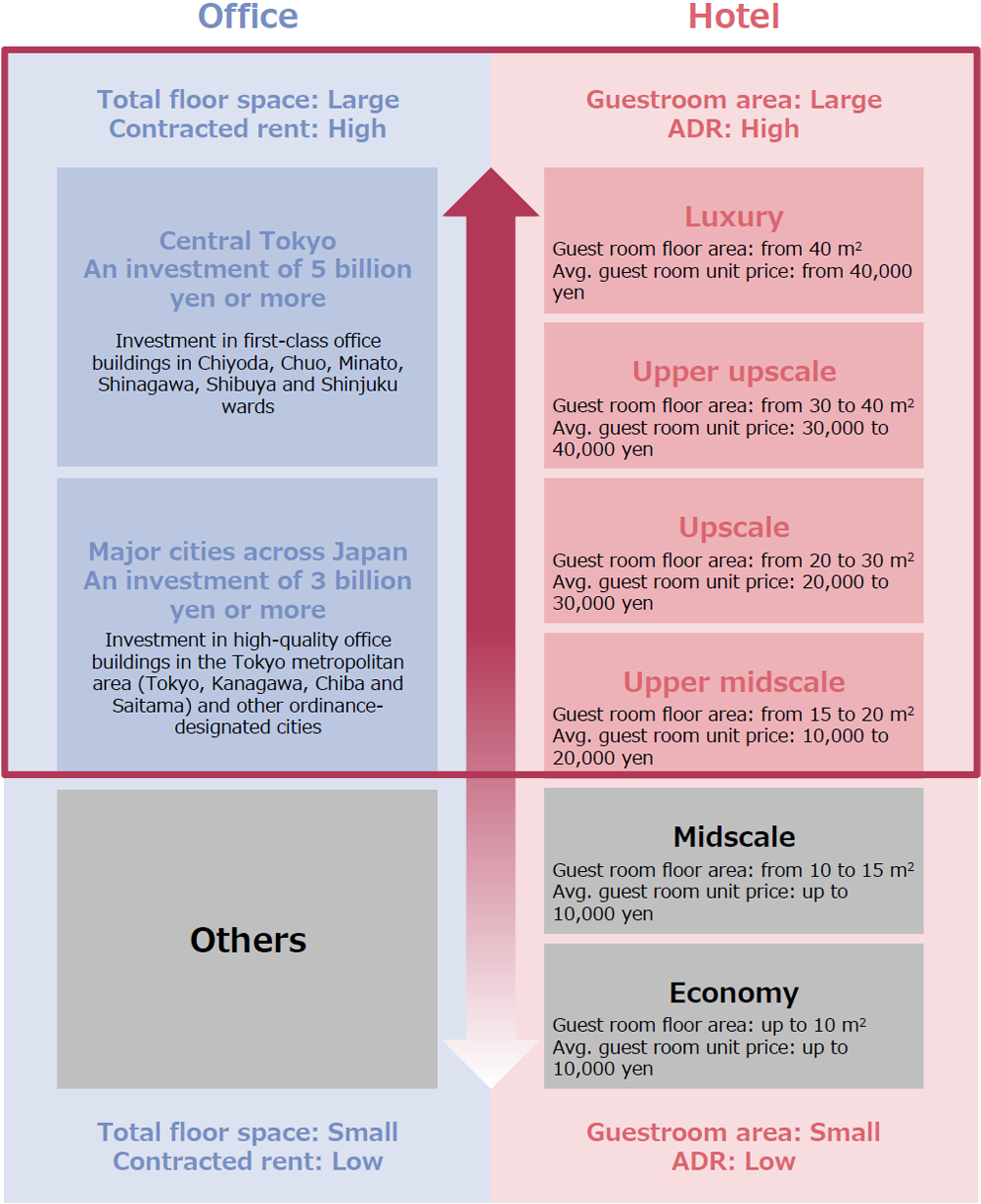

Intensive Investment in High-quality Assets

Building a portfolio with both stability and growth potential based on its core assets, offices and hotels

Intensive investment in high-quality, high-grade assets with asset potential leveraging the support of Mori Trust Group assets

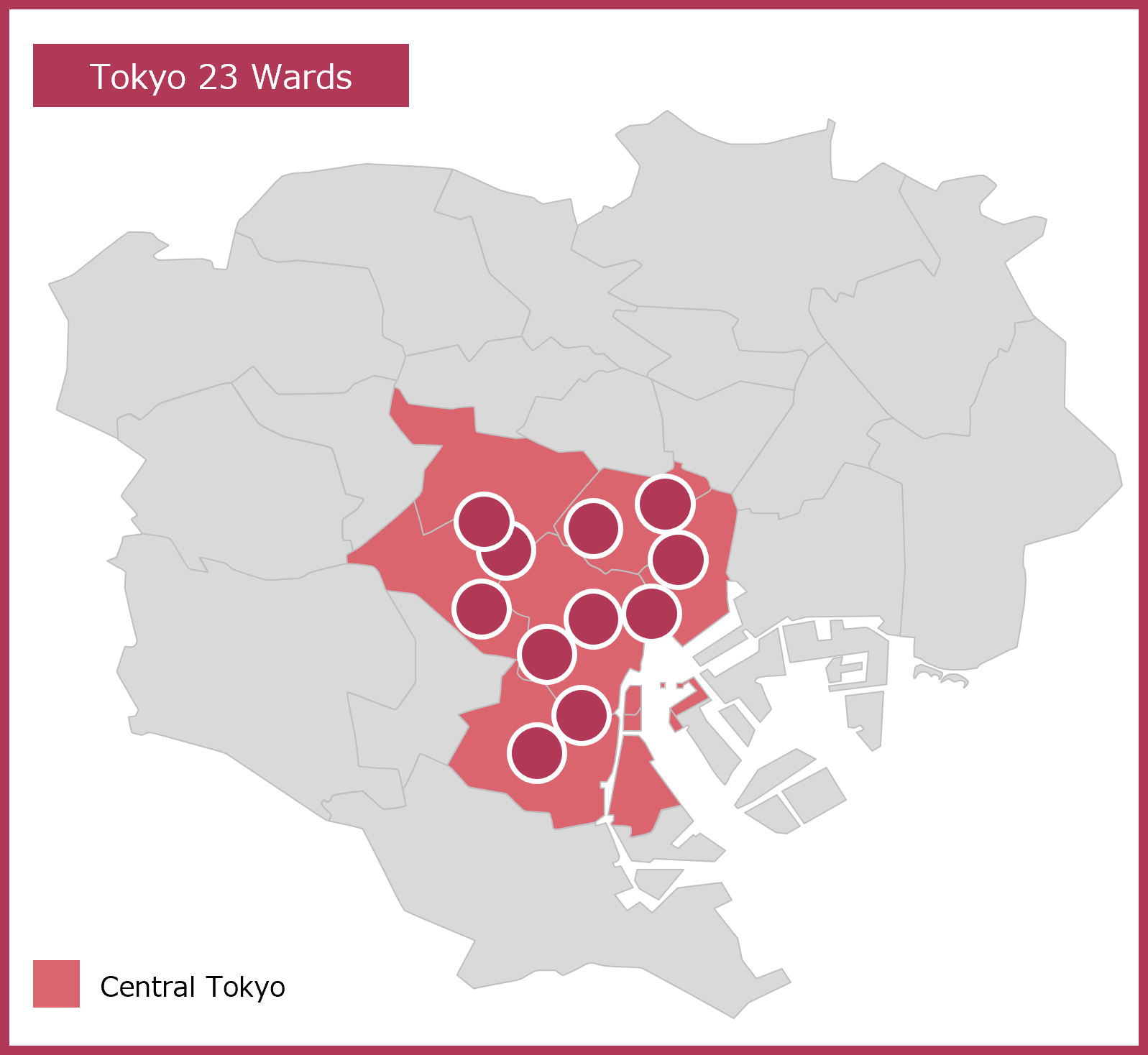

Asset potential: located in major cities across Japan,

concentrated in central Tokyo

Properties located in central Tokyo are 78.3% of the entire portfolio

96.0% of the portfolio is properties in major cities across Japan

Grade: Intensive investment in high-quality, high-grade properties

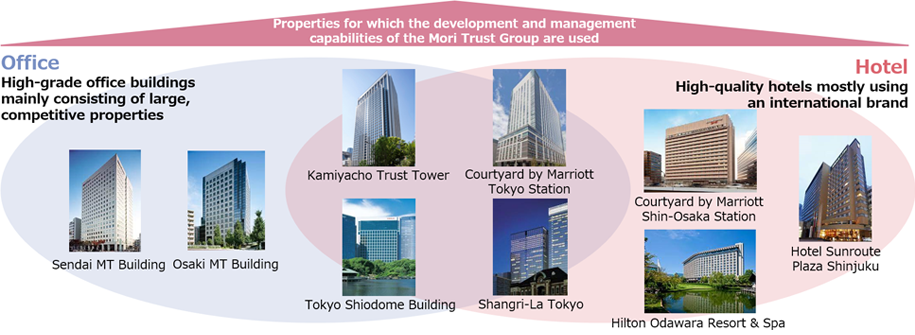

Portfolio Consisting Primarily of High-quality Properties Developed by the Sponsor

Building a portfolio with high asset potential consisting primarily of high-quality properties developed by the sponsors, which can be destinations for people to gathering

Portfolio including high-grade assets with asset potential and an increase in stability

Investment ratio by area

Percentage of properties using an international brand

(Hotel)

| (Note) | International brand hotels refer to Shangri-La Tokyo, Hilton Odawara Resort & Spa, Courtyard by Marriott Tokyo Station and Courtyard by Marriott Shin-Osaka Station. Conrad Tokyo housed in the Tokyo Shiodome Building is not included in international brand hotels as the category of multi-use properties is determined based on their main use. |

|---|